What is payment tokenization? How PSPs improve a payment journey

- Tokenization converts sensitive card data into random code during the payment journey.

- Tokens can be used in online checkouts, recurring billing, and mobile wallets.

- Tokenization can protect cardholders and PSPs from financial crime.

- Tokenization increases sales by creating easy checkouts for returning customers and recurring payments.

- Rapid advances in financial crime and technology make it essential to review regularly.

Payment tokenization explained

Tokenization is a technique that replaces sensitive card data, such as name and primary account number (PAN), with a unique random code.

Tokens are ideal for storing sensitive data against financial crime such as unauthorised access (internal fraud) and data breaches (external hack).

Tokens increase sales by reducing the need to re-key data, creating a speedy checkout for returning customers, enabling recurring payments, and storing details in digital wallets.

What tokens do PSPs use?

Single-use tokens are only valid for one transaction.

Multi-use tokens can be used for recurring payments.

Network tokens are issued by card schemes like Visa and Mastercard for specific devices or merchants.

How does payment tokenization work?

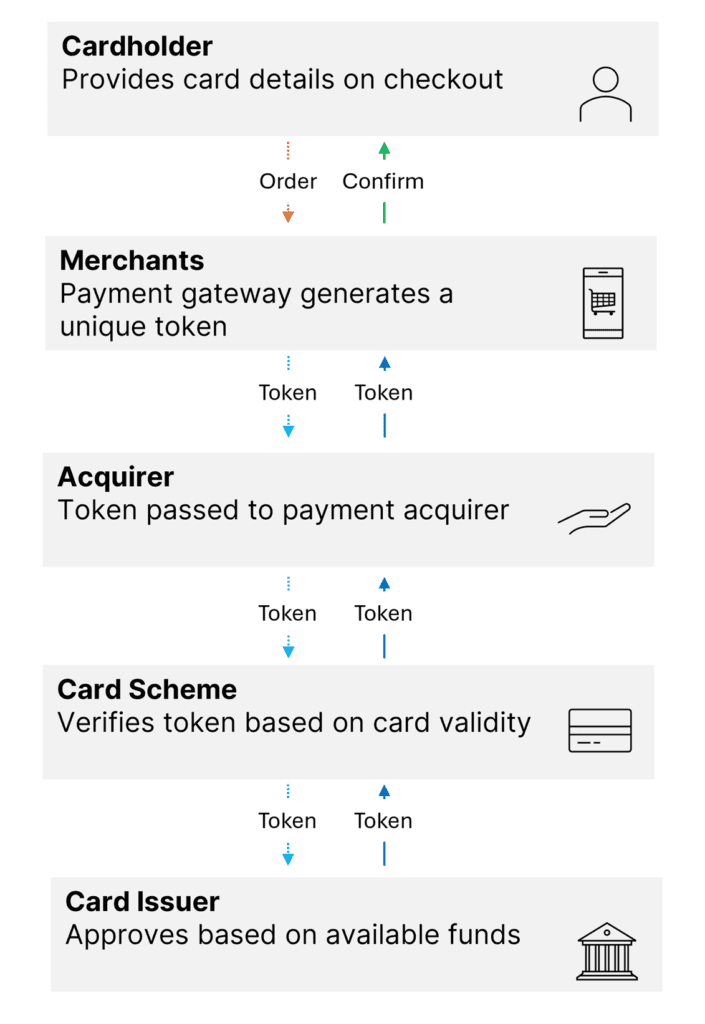

Tokenization occurs when a cardholder enters their payment on a website or mobile app. The payment gateways of the PSPs generate a token which is passed between stakeholders in the payment journey:

Payment tokenization for recurring payments

Tokens are reusable within certain parameters, making them ideal for businesses where customers purchase repeatedly, have loyalty schemes, subscriptions, or digital wallets.

Rather than ask the client to re-enter details, the business utilises the stored token, adding a verification step such as CVC or 2FA as appropriate.

Benefits of payment tokenization

Enhanced Data Security

Holding data in tokenized form makes it illegible to fraudsters and hackers who use card data for illicit purposes. As financial crime booms, tokenization is critical for eCommerce and PSPs.

Increased Sales

Tokenization improves the checkout experience as it removes the need to re-key card details, reducing friction and increasing conversions. Tokenization also protects customer card data, a key trust factor in recurring purchases.

Omnichannel Capability

Tokenization can be applied to any card regardless of whether the transaction occurs in an eCommerce or digital wallet environment. Standardization across channels helps reduce complexity and costs.

Demonstrate PCI Compliance

Tokenization is a key criteria of the Payment Card Industry Data Security Standard (PCI DSS) that merchants, payment gateways, and a PSP are required to meet to process card payments.

Automated Updates

In some cases, tokens can be updated automatically by the provider, allowing recurring payments to occur without interruption.

Is tokenization the same as encryption?

No. Tokenization replaces data with a random token whereas encryption scrambles data using cryptography. Tokenization is not mathematical, encryption is and may be deciphered. In reality, a payment journey will use both, tokenization for data storage, encryption for data transmission.

Summary of payment tokenization

To succeed in ecommerce and fintech requires the seamless integration of excellent customer experience with effective financial services and technology. Payment tokenization is the enabler of that.

As financial crime booms, it is also a critical element of maintaining high security as data is passed and stored along the payment journey.

With AI enabling more elaborate financial crime, merchants and PSPs must adopt the highest levels of protection and review arrangements regularly.